How many times do you look at your bank statements – really look? You, like all of us, probably have habits you can trim out like the cup of Starbucks each morning or the sale item you just had to have. It’s hard for us to ignore good deals and fun extras. Trust me, I’m right there with you.

But, let me pose a challenge – Shock yourself.

Because if you don’t track every purchase, it probably will be a shock when you click on your bank statement.

How’s about this: Find some quiet time right after you read this post and try to think about what you bought yesterday. Write it all down. Then, go check your bank statement and see if you missed anything. It’s amazing how easily we can forget a candy bar or a car wash, both of which are in a class of small meaningless purchases that can add up to an entire vacation when the year is through.

I certainly make mistakes in this arena, but I can’t afford to anymore. One week from today, I will board a plane to the Caribbean and for the first time ever, both the hubs and I will be job-less.

I’m not ashamed to tell you that we will be living off of my husband’s student loans. Grenada has laws preventing non-natives like me from working, but many of the spouses of medical students down there babysit or teach a class or start up a little business. We made a very conscious decision to live this way. Both of us had great jobs in Richmond. But we believe life is about living. And this is his dream. And my dream? To write. Preferably to get paid to write. I have some potentially good news in this arena when things seem more official.

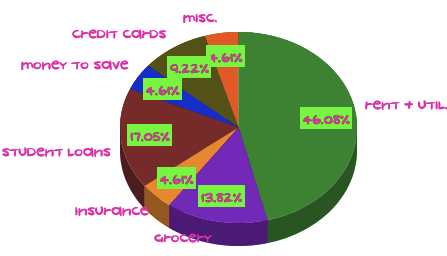

Back to my point about finances. I don’t have room to mess up. My budget is tight, peeps. I have a +/- $30.00 wiggle room which I’m hoping will get better once I figure things out. Here is the pie chart I have made of our budget from now until Christmas.

One thing you’ll notice on my chart is credit cards. When we got married, we had four of them. Now we have two of them. I wish I could say we bought fun things with them, but they are currently filled with international plane tickets. I’m ready to give these credit cards a drop kick in the face. I don’t care how much I have to sacrifice – I want them gone!

So like I said, I don’t have room to mess up financially. But, then I got to thinking…

None of us have room to mess up.

Many of you have kids and mortgages and jobs that could come and go in a bad economy. Live you life. Enjoy the things that matter – your family, your pets, the fact that you were granted another day and not the big screen you just bought. I promise you, after you shock yourself (by looking at that bank statement), it’s amazing how much your mindset changes.

Yep, I hear you! I don’t have room to mess up – because if I do, it means that my savings (aka cubicle escape plan) will not grow at the rate that I need it to.

I’m a huge fan of the book “I will teach you to be rich.” It was the first finance book that had ideas that really worked when I applied them to my life.

I have included my morning coffee at the coffee shop in my budget, because it’s a little thing that makes me happy. And I’ve never been good at staying prepared at home and always having my coffee ready to make myself. So I decided that it was worth it, but I needed to actually budget for it. Because, like you said, those little “extras” really DO add up!!

Those little “deals” that get so many people to spend extra here and there are SO not worth it in the long run, if it means that you’re not able to pay your bills or save money!

Have you seen this article about the plastic beads? It really hit home for me. Because I used to be that girl. http://www.violentacres.com/archives/30/you-can-learn-a-lot-from-a-rich-girl/

Kelly and I have always been super aware of our finances ever since we started grad school. We rarely eat out, we have friends over instead of going out, we make our own coffee, are big fans of leftovers, and wait for something to go on sale before we buy it. Kelly’s salary doubled since he is a post doc now, but we have no intentions of changing our spending habits. We hope to live on his salary while saving mine in the hopes of having an awesome down payment for a house or car one day. The little sacrifices we make now will totally be worth it in a few years.

Good luck with the upcoming move. We love you guys and hope that everything goes well!!

Great post. You can totally do it! Imagine how great it’ll feel to be on the other side of this, having saved and paid off credit cards and sacrificed! We’re trying to get our mortgage paid off early, so every time I buy something, I think – this purchase is adding days/weeks/months to our mortgage. Is it worth it?

PS, now I’m super intrigued about your comment about getting paid to write! 🙂

Can’t wait to hear more about your writing gig. (I hope I’m not jinxing it by saying that!)

Bravo for taking a carpe diem attitude about it all. I’m sure it will be tough to be on such a tight budget, but it is SO worth it, and it will pay off big time over the long run.

Good luck with the move!

xoxo,

tanja